With the many social and economic changes that have occurred in the last few years, along with the advances in automation and technology, automated palletising systems are becoming more financially viable than ever before.

In this article we will cover a few of these factors and explain how they have made automated palletising more financially viable for a large number of businesses.

- Rising Wage Costs

Rising wage costs, along with the fact that automated technology is becoming cheaper and more commonplace, has had the effect of closing the cost gap between palletising by hand and automating it. Currently, if you have staff palletising by hand, they are entitled to breaks throughout their shift, and this can mean that production stops during these breaks. Staff can also be unexpectedly off sick at short notice, which can have the effect of stopping your production process and reducing production output. An automated system will continue to palletise 24/7 and keep your production throughput consistent, quickly improving the payback time of an automated system. - Labour Shortages

Since Brexit, there has been a nationwide labour shortage, which is expected to last until at least 2023 and potentially beyond. This has also been compounded by Covid, and many manufacturers are finding it increasingly difficult to recruit staff to perform manual jobs within their production processes. Automating your palletising process gives you the security of knowing that you don’t need to recruit for this area, and staff can be redeployed elsewhere within to company to perform other tasks. It also gives you the peace of mind, knowing that your palletiser will never phone in sick or have unexpected days off and will be ready to work 24/7. Depending on the layout of your production, one palletising system will often be able to palletise off multiple lines, and dramatically reduce the head count needed for manual palletising. - Advanced Software

There have been many advances in automated technology over the recent years, and these developments have led to a reduction in the cost of automation. One of the key areas this has affected in palletising, is the fact that some palletising systems no longer need to be programmed by a skilled robot programmer, they can be programmed by your factory staff instead. This enables you to palletising different sizes of box or bag off one system, and saves having to pay for a skilled robot programmers time each time you need to set up a new bag or box size.

- Palletisers That Change With Your Process

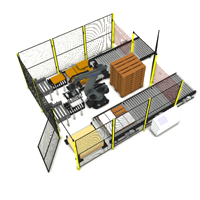

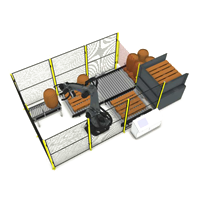

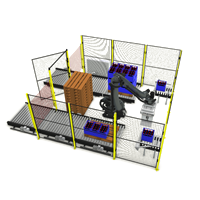

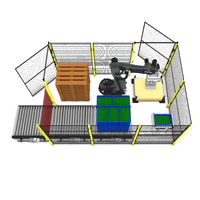

Some palletiser designs have moved away from the traditional style, and have been created to grow with your company; the Granta GA15 palletiser is an example of this. It has been designed as a modular system, that can be added to as your production grows. It can also be easily moved to a different area of your site if your requirements change. This saves you having to make large capital investments on new palletising systems as your production process change, instead you can simply purchase additional modules for your current system as you require them.

- Finance Leasing Schemes

Finance leasing schemes are available and enable you to realise the benefit of automation without having to make a large capital outlay. To give you an example; over the last few palletising projects we have installed, with a 3 year lease scheme, our customers would make an average production cost saving of £63,063.60 per year after making the lease payments. These savings do not include the value of any production increase, which with a palletiser is typically at least 15%, and more commonly around 40%. They also don’t include any of the other benefits such as; reduced H&S claims, reduced HR, and boosted staff morale. This makes purchasing a palletising system on a finance lease scheme a very attractive option for smaller businesses that don’t have the capital available for an initial outright purchase.

- Super-deduction Scheme

The UK Governments Super-deduction scheme is a very attractive tax incentive: for capital expenditure incurred from 1st April 2021 until the end of March 2023, companies can claim 130% capital allowances on qualifying plant and machinery investments. It allows companies to cut their tax bill by up to 25p for every £1 they invest. This scheme has been created to encourage firms to invest in productivity-enhancing plant and machinery assets that will help them grow, and to encourage them to make those investments now. Taking advantage of this scheme will effectively enable you to purchase a £100,000 palletising system for as little as £75,300.

- Payback On Investment

Typically the payback time on a palletising system is very quick. This is due to the fact that not only are you saving on staffing costs, but you are also improving the OEE of your process. Other factors that are often overlooked and affect the payback time include: production throughput increase, reduction in defects/damage, less downtime, reduction in RSI issues. These two downloadable calculators will enable you to work out the predicted payback time for your process; automation payback calculator and intangible benefits calculator.

As you can see, with the many changes there have been in recent years, along with the current Super-deduction scheme being offered by the UK Government, investing in palletising equipment is a very viable option for most businesses. For each company it is obviously slightly different, but as a rule of thumb, if you have the equivalent of one person employed full time for palletising, there is payback in less than 2 years.

Warning: Undefined variable $aria_req in /var/www/granta-automation.co.uk/news/wp-content/themes/twentyten/comments.php on line 81

Warning: Undefined variable $aria_req in /var/www/granta-automation.co.uk/news/wp-content/themes/twentyten/comments.php on line 86