Manufacturing has long been the backbone of industrial growth, powering economies and shaping societies. Yet, in today’s volatile and hyper-competitive environment, the pressures facing manufacturers are more intense than ever. Global supply chain disruptions, escalating input costs, rising sustainability demands, and rapidly shifting customer expectations are redefining the rules of the game.

For leaders at the helm, stability is no longer sufficient. The challenge is to balance short-term performance with long-term resilience—constantly evaluating operations, driving efficiencies, and ensuring financial performance is not just maintained, but positioned for sustainable growth.

Operational excellence and financial discipline must therefore move in lockstep. One without the other risks eroding competitiveness and profitability. What follows is a structured, actionable framework for assessing current performance and strategies that can be implemented to secure enduring competitive advantage.

1. Establishing a Clear Baseline: Evaluating Current Operations

Before embarking on improvement, it is important to have a complete and accurate picture of where the organisation stands.

Key Dimensions of Operational Evaluation

- Production Performance Metrics

- Overall Equipment Effectiveness (OEE): A single, powerful metric that combines machine availability, performance speed, and output quality. An OEE below 65% usually signals significant inefficiencies.

- Yield and Scrap Rates: High scrap rates indicate quality issues or poor process control.

- Cycle Time & Throughput: Are you producing at the designed capacity of your equipment?

- Process Mapping and Bottleneck Identification

Value Stream Mapping (VSM) is a proven method for identifying non-value-added steps. Bottlenecks could be machine-related, supplier-related, or even decision-making delays at management levels. - Workforce Effectiveness

Assess whether workers are underutilised, overburdened, or misaligned with process needs. A plant may have state-of-the-art machines, but without properly trained and engaged employees, efficiency will stagnate. - Benchmarking Against Industry Peers

Comparing KPIs—such as unit costs, lead times, and customer on-time delivery rates—against competitors provides an external view of performance gaps.

Tangible Step: Commission a comprehensive operational audit every 12–18 months, either internally (using cross-functional teams) or through external experts, to ensure objectivity.

2. Strengthening Production Efficiency and Operational Excellence

Improvement begins with process discipline. High-performing manufacturers consistently invest in leaner, smarter, and more reliable operations.

Proven Approaches

- Lean Manufacturing Practices

- Implement 5S (Sort, Set in order, Shine, Standardise, Sustain) to maintain organised and efficient workspaces.

- Conduct Kaizen events (rapid improvement workshops) focused on specific problem areas.

- Apply Just-in-Time (JIT) principles to reduce excess inventory and improve cash flow.

- Automation and Digital Transformation

- Integrate Manufacturing Execution Systems (MES) to provide real-time data on production performance.

- Use IoT-enabled predictive maintenance to minimise unplanned downtime and extend asset lifespans.

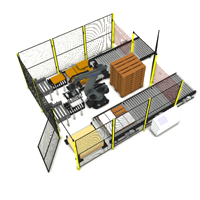

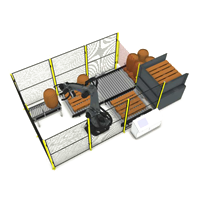

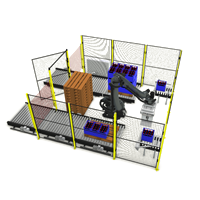

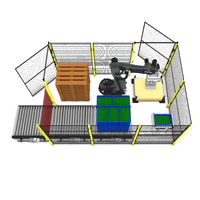

- Explore robotics and cobots (collaborative robots) to enhance consistency and reduce manual errors.

- Maintenance Strategies

- Transition from reactive maintenance (fixing when broken) to predictive maintenance (fixing before failure).

- Adopt Total Productive Maintenance (TPM), involving operators directly in routine machine care, which builds accountability and reduces disruptions.

- Standardisation and Quality Assurance

- Develop clear SOPs for every critical task and monitor compliance.

- Use Six Sigma methodologies to reduce variability and defects.

Tangible Step: Target a 10–20% reduction in downtime by combining predictive maintenance and lean process improvements within the first year of implementation.

3. Optimising Supply Chain and Inventory Management

A resilient and efficient supply chain is both a cost lever and a competitive differentiator.

Practical Strategies

- Supplier Relationship Management

- Create scorecards tracking supplier performance on quality, cost, and delivery reliability.

- Negotiate long-term contracts with key suppliers to stabilise pricing and supply continuity.

- Inventory Optimisation

- Use ABC analysis to categorise inventory into high-value, medium-value, and low-value items, aligning stock policies accordingly.

- Implement Demand-Driven Material Requirements Planning (DDMRP) to adjust inventory based on real consumption rather than forecasts.

- Risk Diversification

- Establish dual sourcing for critical raw materials.

- Build regional supply networks to reduce reliance on single geographies.

- Digital Tools for Visibility

- ERP systems that integrate procurement, production, and logistics offer end-to-end visibility and faster decision-making.

- Use AI-powered demand forecasting tools to align supply with actual market needs.

Tangible Step: Set a target to improve inventory turnover ratio by 15–20%, freeing up cash tied in stock without risking stockouts.

4. Evaluating Financial Performance with Precision

Operational improvements must translate into stronger financial outcomes. A Managing Director must go beyond the P&L and scrutinise the underlying drivers of profitability and cash flow.

Key Areas to Evaluate

- Cost Structure Analysis

Break down costs into direct labour, materials, energy, and overhead. Identify “cost sinks” and evaluate outsourcing or process redesign. - Working Capital Management

- Shorten receivables cycle through stricter credit controls and faster invoicing.

- Optimise payables strategy to balance supplier goodwill with cash flow efficiency.

- Improve inventory turnover as highlighted earlier.

- Profitability by Product Line and Customer Segment

Contribution margin analysis often reveals “hidden losses” where certain customers or product lines consume disproportionate resources. - Capital Efficiency

Measure Return on Invested Capital (ROIC), ensuring every pound of capital employed generates acceptable returns.

Tangible Step: Introduce a monthly financial performance dashboard for the leadership team, tying operational KPIs directly to financial results.

5. Driving Financial Improvement Through Strategic Initiatives

Once evaluation is complete, the MD must champion actionable initiatives that directly lift profitability.

Actionable Levers

- Pricing Optimisation

- Move from cost-plus pricing to value-based pricing, particularly for differentiated or high-precision products.

- Use data analytics to assess price elasticity and capture higher margins without losing competitiveness.

- Cost Transformation

- Consolidate administrative functions into shared services.

- Implement energy efficiency programs (e.g., heat recovery systems, LED retrofits) to reduce overheads.

- Revenue Diversification

- Introduce new product lines in response to evolving customer needs.

- Enter new geographic markets to reduce dependence on cyclical domestic demand.

- Capex Discipline

Apply strict payback period and ROI analysis before approving new machinery, automation, or plant expansions.

Tangible Step: Target a 5–10% improvement in EBITDA margin over 24 months through combined pricing, cost, and product-mix initiatives.

6. Building a Culture of Continuous Improvement

Operational and financial improvements cannot be sustained without cultural alignment. People, not just processes, drive long-term success.

Practical Cultural Strategies

- Employee Engagement and Empowerment

- Introduce employee suggestion schemes tied to tangible rewards.

- Organise regular Kaizen circles for frontline workers to propose and implement process enhancements.

- Transparency Through Performance Dashboards

- Share plant-level KPIs (OEE, scrap rates, delivery performance) visibly on shop floor boards.

- Cascade financial targets down to departmental levels, ensuring every team understands how their performance ties to company profitability.

- Cross-Functional Collaboration

- Break silos between production, procurement, finance, and sales through integrated project teams.

- Introduce end-to-end process ownership instead of departmental KPIs that sometimes conflict.

- Leadership Development

Invest in training for supervisors and middle managers, enabling them to act as change agents and carry improvement initiatives forward.

Tangible Step: Run quarterly “continuous improvement sprints”, where cross-functional teams tackle one high-impact operational or financial challenge.

7. Harnessing the Power of Data and Analytics

Data is the backbone of modern decision-making. Manufacturing leaders who embrace analytics consistently outperform peers.

How to Apply Analytics in Practice

- Real-Time Operational Dashboards

Track live production performance, machine health, and order progress to spot issues before they escalate. - Predictive Analytics

Use machine learning to forecast demand patterns, anticipate supply disruptions, and schedule maintenance before breakdowns. - Profitability Analytics

Conduct cost-to-serve analysis to fully understand which customers or orders are most profitable after considering logistics, service, and after-sales costs. - Scenario Planning

Use financial models to test “what if” scenarios (e.g., energy cost spikes, currency fluctuations) and prepare responses in advance.

Tangible Step: Implement a data analytics program with measurable ROI, such as reducing maintenance costs by 10% through predictive insights within 12 months.

In summary, evaluating and improving operations and financial performance is a continuous cycle, not a one-off initiative. It requires a structured framework:

- Evaluate comprehensively through audits, metrics, and benchmarking.

- Improve systematically using lean, automation, and supply chain optimisation.

- Align operations with finance by focusing on costs, working capital, and profitability.

- Embed culture and data as enablers of continuous improvement.

The most successful manufacturing leaders are those who combine sharp operational insight with financial acumen, all while cultivating a culture of accountability and innovation. In doing so, they not only safeguard margins today but also secure the company’s competitive edge for the future.

You may find these downloadable tools helpful in your calculations

- OEE Calculator – download here

- Intangible Benefits Calculator – download here

- Palletiser Savings Estimator – access here

Find out more…

- Planning for 2026: How Granta Automation Can Transform Your Operations with Palletisers and AMRs

- Which Palletiser System Is Best for Palletising Boxes?

- Common Pitfalls in Scaling Manufacturing Operations

- What is an Automated Guided Vehicle (AGV) and What are the Benefits of Investing in One?

- How Many Boxes Per Hour Can a Robotic Palletiser Handle?